a Decade of Disruptive Change

An excerpt from the new book Strategy and Change, coming September 2025

In 2015, we profiled several well-known organizations that helped us illustrate strategic leadership in practice. The four we featured most prominently are ones you would probably recognize: General Electric, 3M, The Walt Disney Corporation, and the nation of South Africa under the leadership of Nelson Mandela.

We called these four examples ‘archetypes’ because they reflected specific, unique attributes of strategy and leadership in practice. Given their prominence at the time, it’s worth checking to see how they’ve fared in the decade since our book was released.

General Electric: 2015 to 2025

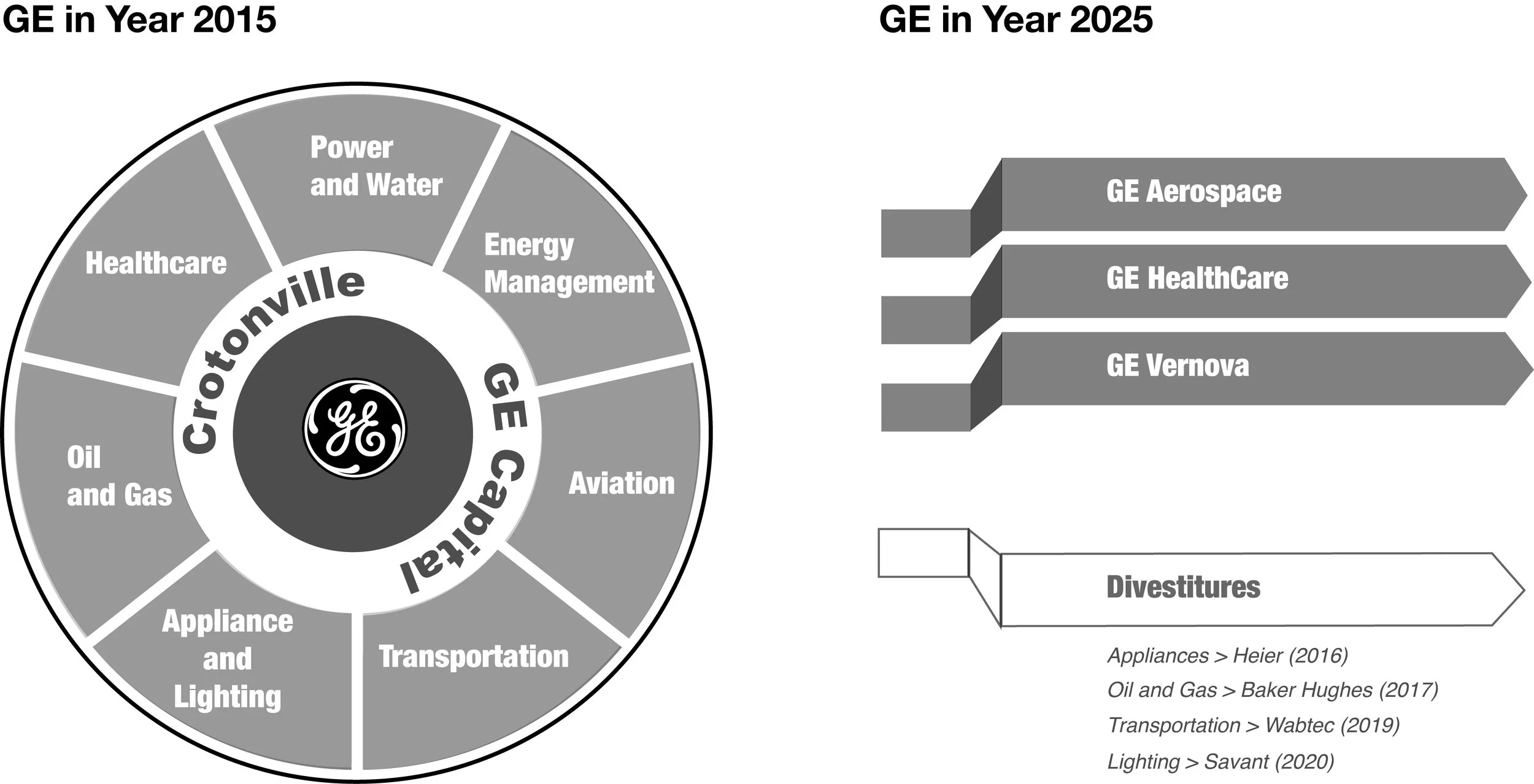

In the following decade, General Electric (GE) experienced a profound transformation which impacted the very nature of the company, moving it away from its pioneering roots as a diversified conglomerate to becoming a much more narrowly focused enterprise. This transformation shifted the company’s focus, changed its governance structure, and significantly impacted its financial performance.

In 2015, GE was a massive conglomerate spanning various industries, including healthcare, power, aviation, oil, and finance. However, the company was facing growing concerns about its cumbersome size and declining profitability, which led to major restructuring efforts. Under CEO Jeff Immelt, GE had already started shifting away from its finance business by selling much of GE Capital and focusing more on its industrial segments in aviation and healthcare.

By 2024, GE had completed a series of significant spinoffs and transformations, fundamentally changing the company’s profile and offerings. GE Healthcare became a standalone company in 2023, marking a key moment in GE’s reorganization. In April 2024, GE also divested its renewable energy and power divisions to form an independent entity called GE Vernova. The remaining entity, GE Aerospace, reflects GE’s shift toward aviation, which has become central to its business. This transition allowed each operating unit within the portfolio to operate with greater freedom and agility, focused on the unique needs of their specific sector.

In 2015, GE reported revenues of about $117 billion. This figure was supported by a diverse portfolio, but the company was burdened by suboptimal performance in the power and energy segments as well as the GE Capital business. Over the subsequent years GE’s stock performance weakened, and its market value declined significantly. This downward trend ultimately led to Jeff Immelt’s departure from GE in June 2017. After a brief period of volatility in the executive ranks, Larry Culp was appointed as GE’s Chairman and CEO on October 1, 2018. Culp was chosen to lead GE because of his successful track record as the CEO of Danaher Corp., where he significantly bolstered the manufacturer’s performance and revenues. Culp’s appointment helped revitalize GE through the adoption and implementation of management principles and practices emphasizing aggressive restructuring and a renewed focus on lean manufacturing, operational principles of continuous improvement and efficiency that Culp previously championed at Danaher. These moves helped GE tackle deep-rooted issues that ultimately reversed its downward trend.

By 2025, GE’s transition had helped refocus efforts within each “go-forward” company on more sustainable growth areas like aerospace and renewable energy. However, challenges remain, especially in GE Vernova, where profitability has been inconsistent due to supply chain issues and fluctuations in energy markets. Nevertheless, each company’s focus on growth sectors, coupled with a leaner, more focused strategy, positions them for continued growth into the next decade.